David Zeiler and I have known each other and worked together for 20 years now. We worked together at The Baltimore Sun, and I hired Dave here when I helped launch and then ran Money Morning.

We’ve become good friends.

I’ve become one of his biggest admirers.

Indeed, I even started a kind of “running gag” with Dave on Twitter, where we’re both active users. Anytime I see Dave post something substantive about Bitcoin or other cryptocurrencies, I “reply” with some variation of this tweet:

#Attention: If you aren’t following @moneymorning #cryptocurrency editor @DavidGZeiler, then you really aren’t following #bitcoin or #ethereum or the #blockchain. Dave is a #mustread/#mustfollow expert on #cryptocurrencies.

Here’s the thing…

While I admit that this is a “running gag” between us, what I’m actually saying is no joke.

No joke at all.

In just a few short years, Dave has become one of the most prescient, most widely read chroniclers on cryptocurrencies. He’s part of the amazing “bench” that Publisher Mike Ward has built here at Money Map Press – and underscores why we’re “investment idea leaders” in areas like technology, cryptocurrencies, energy, medical marijuana, options trading (and trading systems), and wealth creation.

That’s why I invited David to talk specifically about Bitcoin and cryptocurrencies.

Dave amassed his expertise the “right” way – through immersion. He was one of the early Bitcoin “miners” – back when it was still possible for an individual investor to be a go-it-alone cryptocurrency prospector.

Since then, as an Associate Editor at Money Morning, Dave has become one of the industry’s foremost writers/analysts about all things related to cryptocurrencies.

And he’s made some stunning calls along the way.

In early 2016, when Bitcoin was trading at $450, Dave predicted – on the record – that the crypto coin could zoom to $2,000 – and then go higher from there.

Much higher.

As we know now, Bitcoin did soar – just as he predicted. It zoomed past $19,000 before the crypto market collapsed.

When we last talked to Dave, it was during the big Bitcoin sell-off early in the year.

As part of the activities here at 2018’s midpoint, I thought Dave would offer some terrific insights about what to expect in the last half of the year.

He didn’t disappoint…

Crypto Investors Are Set for an Eventful Six Months

William Patalon, III: Okay, Dave – well, we’re certainly in an interesting area when it comes to Bitcoin and its cryptocurrency brethren. The year’s first half has been rough – really rough. Here at the year’s midpoint, and as we look downhill to 2018’s second half, what’s foremost on your mind?

David Zeiler: Well, what I’m looking for – specifically – is a catalyst that will snap Bitcoin and all of its “crypto brethren” out of the slump the sector has been in for the entire year.

Actually, Bill, there are several catalysts – it’s really a question of which one happens first.

My money right now is on the Lightning Network. Lightning is a technology that vastly increases the capacity and speed of the Bitcoin network by allowing transactions to take place in “payment channels” off the main blockchain.

WPIII: Lightning is still a work in progress, though, correct?

DZ: That’s right, Bill, but folks who haven’t followed it closely might want to consider this carefully. You see, Lightning went from “test mode” to “live mode” in March.

“Millionaire-Maker”: A potential upgrade taking place behind the scenes could send the Bitcoin price to unprecedented highs. Few people even know about this game-changer. Click here to learn how you could make millions…

WPIII: So this just happened, then…

DZ: That’s correct. Right now, the developers are working hard to make these features user-friendly so that the masses can take advantage of them. When that happens, you’ll see adoption skyrocket and the Bitcoin price along with it.

WPIII: That’s pretty cool, Dave. What else?

DZ: The other major catalyst on the horizon is big institutional money coming into Bitcoin.

WPIII: You and I have talked about this “offline.” As you know, I covered the money management/wealth management sector for years in Upstate New York – where there’s a lot of “Old Money” – and have followed the sector and its trends ever since. And one thing that I keep hearing is that high-net-worth investors are looking to put their cash to work in two key areas of opportunity.

DZ: Legalized marijuana and cryptocurrencies…

WPIII: (laughing) That’s right, Dave, that’s right.

DZ: I think that still holds true in the long run. But I also believe the spike in prices last year and the subsequent big drop has made them wary. A lot of the crypto hedge funds that launched last year got hurt. But as the crypto market recovers, the big players will want in. They’re also waiting for proper regulation by the U.S. Securities and Exchange Commission [SEC]. The current “Wild West” nature of crypto trading is a bit too risky – now – even for a lot of hedge-fund managers.

In the long run, it doesn’t matter which of these catalysts hits first. It’s going to be a “one-two punch” that will start driving Bitcoin higher in the second half of the year and well into 2019.

WPIII: So let’s consider the outlook for the U.S. and global economies – and the financial system in general – and relate that to your expectations for Bitcoin et al.

DZ: Obviously, crypto prices aren’t affected by the economy the way that stock prices are. But cryptos could turn out to be a great “safe-haven investment” in the last half of 2018 if the stock markets take a tumble. All the capital fleeing stocks will have to go somewhere. Have to.

You know, some of this cash will move into gold and other precious metals. But Bitcoin and Ethereum prices could get a boost from any significant pullback in stocks – especially if that sell-off is triggered by a fear-inducing event.

WPIII: Such as…

DZ: I’m talking about things like President Donald Trump’s trade wars, a confrontation with Iran, a major incident in the South China Sea – which I know you’ve been chronicling for years and were way ahead of everyone in assessing. I think President Trump makes Wall Street nervous, especially when it comes to foreign policy – because he’s unpredictable. That unpredictability is bad for stocks – but good for crypto.

READ MORE: The South China Sea showdown is dangerous, but one small firm could potentially save the U.S. Seventh Fleet. Click here…

WPIII: Okay, given all the ground we’ve already covered here, let’s get to your predictions. What’s your outlook for the crypto market in the last six months of this year? And beyond, if you want to go out that far…

DZ: Well, Bill, it goes without saying that the first half of the year has been rough for crypto. Most of these coins are down 65% to 70% from the all-time highs they reached back in December. But lately, the decline has leveled off. To some extent, news and other current events will drive prices. But I do believe one or more of the catalysts mentioned earlier will take hold by late summer or fall.

WPIII: And if or when that happens?

DZ: Prices will bounce back. And once they start to move up, they’re likely to move fast. That’s what we’ve seen in previous Bitcoin recoveries. And the recovery ahead of us – whenever it comes – will be the biggest yet. We’ll get past the all-time highs and then some.

WPIII: Timing?

DZ: Bill, if this doesn’t happen by the end of 2018, then I believe it will happen in the first half of next year, to be sure.

And here’s a key point: This recovery won’t be limited to Bitcoin: It will apply to most of the top cryptocurrencies. They tend to follow Bitcoin.

WPIII: Okay, so we’ve talked about your prediction, your “forecast.” What are the biggest threats – the biggest “wild cards” – that could impede this?

DZ: In my mind, regulation is the biggest wild card. We know the SEC is looking hard at cryptocurrencies in general and ICOs [initial coin offerings] in particular. So is the U.S. Commodity Futures Trading Commission. A lot of crypto veterans think regulation will be a disaster. They think the regulators want to kill cryptos or strangle their revolutionary potential.

WPIII: But you don’t believe that, do you?

DZ: No, I don’t. In fact, it doesn’t even make sense. They – the regulators – certainly want this to succeed.

Stunning: New innovation will be like “adding twin turbos to the Bitcoin engine” – and could send its price to $100,000. Learn more…

WPIII: Right, because regulators understand that innovation – and this certainly qualifies – is good for the economy, creating growth, new business opportunities, and needed job growth.

DZ: That’s exactly right.

You know, last fall I interviewed Emma Channing, the general counsel for Argon Group, the investment bank that’s working with the tZero exchange. She told me she talks to SEC officials all the time, and the perception that they’re “out to get” crypto is totally off base. Channing told me the SEC sincerely wants crypto to succeed – but at the same time wants to fulfill its mission of protecting investors.

WPIII: Those two things aren’t mutually exclusive.

DZ: They aren’t. But having the two together – breakthrough innovation and a sturdy, realistic regulator structure – takes more time.

Remember, too, that regulation is one of the key pieces big institutional investors are waiting for. Retail investors, too. People need and want regulatory clarity. People want to know they’re not going to lose all their hard-earned money to a scammer or sink money into an ill-conceived project. Regulation will force transparency and disclosure. When that exists for crypto, it will open the door to a torrent of fresh capital. The only question is how long it will take for the regulators to get the rules in place.

WPIII: Given this backdrop, what’s the biggest opportunity for profit here? What are you most focused on?

DZ: The biggest risk in the crypto world is falling into the trap of thinking that buying the newest and cheapest crypto is the path to fabulous wealth. People imagine that every ICO will be “the next Bitcoin.” But recent experience has shown that a lot of the ICOs out on the margin are scams.

That’s why I actually think there’s still plenty of profit – and less risk – in the major cryptocurrencies like Bitcoin and Ethereum.

Just think about it, Bill: As we sit here talking, Bitcoin is trading at about $6,000. If it gets back to its all-time high within the next year, you’ve tripled your money. Sure, it’s not a 10,000% gain. But we’re not likely to see that again. Some of the better cryptos trading under $1 today might get to $10, but they’re not going to hit $10,000 like Bitcoin did.

If you want to gamble a little, there are the second-tier coins like Cardano, IOTA, Ripple, Stellar, Neo, and Monero. You’re still looking mostly at 3x to 5x gains, though, at least in 2018. The smart move in crypto, since it’s so early in the game, is to diversify among a number of these top prospects. And make sure you include some exposure to Bitcoin and Ethereum, as well. Betting everything on one coin at this point just isn’t smart.

WPIII: Are there other ways to participate? Are there funds, ETFs? Is there a “safety play” or two folks should consider, Dave?

DZ: For some investors, buying individual cryptos is just too scary. There’s a lot of concern about exchanges getting hacked. Plus, you need the technical chops to manage your own wallet.

I get all that, I really do.

So if you’re risk averse but still want to participate in this market of promise and innovation, there are other ways to go.

See Why Bitcoin Is Far from Dead: Cryptocurrency legend Michael Robinson just revealed why Bitcoin could be poised for a record-breaking rebound. Before the mainstream public gets any wiser, you need to see this now.

WPIII: Like “blockchain,” for instance?

DZ: Yes, that’s a great way to go. Blockchain is a kind of “building block” element of the cryptocurrency paradigm. It’s the technology “underpinning” that makes cryptocurrencies work.

There are no “pure play” blockchain companies right now, though a lot of the big financial firms and fintech companies are involved. Given that fact alone, it’s worth investing in the potential of blockchain through blockchain ETFs.

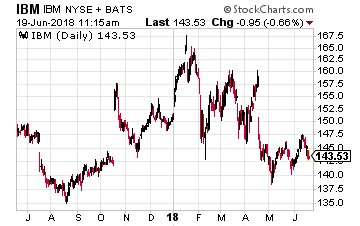

Right now, in fact, there are five of these ETFs. They don’t buy cryptocurrencies. Instead, they buy stocks of companies working on blockchain technology. The portfolios include big tech companies like IBM Corp. [NYSE: IBM] and Microsoft Corp. [Nasdaq: MSFT], as well as smaller companies that are mostly focused on blockchain.

I actually wrote about them recently.

WPIII: Is there one you like the best?

DZ: Yes. If I had to pick one, it would be the Amplify Transformational Data Sharing ETF [NYSE Arca: BLOK]. I like this ETF because it has attracted the most capital and is actively managed, which means it will be able to adapt its holdings quickly in a rapidly evolving sector.

WPIII: This is great stuff, Dave, which is why I really wanted to get you in front of my subscribers again.

Okay, so let’s talk strategy.

Is there a strategy that cryptocurrency investors should use in the year’s second half?

DZ: Well, Bill, when I look at this, the good news I see is that the admittedly steep decline in crypto prices in the first half of the year has brought prices down so much that they’re really cheap – at least for the time being.

And that’s not some attempt to varnish the reality of what has happened. But as you know from our many talks, both in formal interviews and “offline,” I really do believe in this market. I really do believe this is a transformative technology.

You know, Bill, I remember that – a while back – you did this fascinating piece about the “history of money.” You argued that cryptocurrencies were a logical next step in the process.

I loved that piece and your explanation. It was elegantly simple – but so very true.

WPIII: Investors get so caught up in the “gee-whiz” technology that they lose sight of the bigger picture.

DZ: Exactly – that’s exactly right.

Cryptocurrencies are the next logical progression in payment technology. The technology blunts some of the weaknesses of cash, credit cards, and digital payments by offering greater speed, greater security, [and] greater acceptance. Those are all good things.

The one difference is that crypto coins are directly investable.

And that makes them a wealth opportunity – and a good one.

The fact that prices are lower now means that you have a lower entry point than you did six, eight months ago. And lower entry points now mean higher profits later.

Now, given how long you and I have worked together – and how much you care about your Private Briefing subscribers, Bill – I know what you’re about to ask me: Could Bitcoin and other cryptos go lower?

Life-Changing Profit Potential: One tiny firm is rapidly developing the parts for a game-changing technology – and the gains from its stock, trading for less than $10, could turn every $1,000 invested into $4,719. Learn more…

WPIII: Well, you beat me to the draw on that one.

DZ: Have to win sometimes, right? [both Dave and Bill laughing]

In all seriousness, my answer is “yes,” of course they could. But I have to believe that prices aren’t likely to go that much lower before they start to rebound. So the strategy is to invest what makes sense for you – people still shouldn’t make crypto any more than 5% of their portfolio – and to do it sooner rather than later. Those of us who have been involved with Bitcoin for a long time know that the price can leap up just as fast as it dropped. You don’t want to wait until Bitcoin is back up to $15,000 to buy.

WPIII: Dave, this has been great – as always. Thanks for joining us here.

DZ: Always glad to do so, Bill.

Can a $10 Bill Really Fund Your Retirement? The digital currency markets are delivering profits unlike anything we’ve ever seen. 23 recently doubled in a single week. And some like DubaiCoin have jumped as much as 8,200X in value in 18 months. It’ unprecedented... but you won’t receive any of the rewards unless you put a little money in the game. Find out how $10 could make you rich HERE.

Source: Money Morning

WILLIAM PATALON III

WILLIAM PATALON III

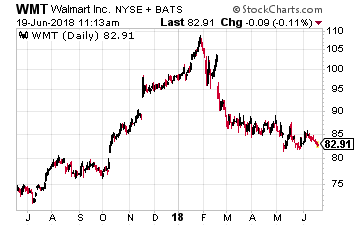

So it is comforting to see that one of the largest food retailers in the U.S. – Walmart (NYSE: WMT) – is beginning to adopt blockchain technology in its food supply chain. Since 2016, Walmart has been working with IBM (NYSE: IBM) to develop software that uses blockchain to track products through its supply chain.

So it is comforting to see that one of the largest food retailers in the U.S. – Walmart (NYSE: WMT) – is beginning to adopt blockchain technology in its food supply chain. Since 2016, Walmart has been working with IBM (NYSE: IBM) to develop software that uses blockchain to track products through its supply chain.